Is it seriously tax time again? Already?! You've got to be kidding me. I swear, it's every freaking year, like clockwork.

Before I get to any freebies, let's get one thing out of the way. If you assume I'm going to take this opportunity to rewatch my favorite Simpsons tax day clip, then you know me too well!

If you're looking to get your IRS tax return in faster than Homer or before another huge backlog piles up, then I've got some free and discounted options below!

Who can file their taxes for free?

According to the IRS, anybody who made less than $79,000 a year can file their taxes for free online. This means roughly 70% of Americans are eligible to file for free!

The IRS has put together a collection of 8 Free File IRS partners that each specialize in certain states and AGI. Here's the full list of providers for the 2024 filing season with direct links to their IRS Free File Program pages and I've listed any free state filings they offer.

Free 2023 Tax Filing Sites

| Website | AGI | Age | EITC | Military | Free Federal | Free State |

|---|---|---|---|---|---|---|

| TaxSlayer | $44,000 or less | Any | ✅ | ✅ | ✅ in all states | ✅ in AR, AZ, DC, GA, IA, ID, IN, KY, MA, MI, MN, MO, MS, MT, NC, ND, NY, OR, RI, SC, VA, VT, and WV |

| FreeTaxUSA | $45,000 or less | Any | ✅ if AGI criterion is met | ✅ | ✅ in all states | ✅ in all states |

| TaxAct | $79,000 or less | 20-58 years old | ✅ if age and AGI criterion are met | ✅ | ✅ in all states | ✅ in AR, IA, ID, MS, MT, ND, RI, VT, WA, and WV |

| Online Taxes | $45,000 or less | Any | ✅ if AGI criterion is met | ✅ | ✅ in all states | ✅ in all states. |

| FileYourTaxes | Between $8,500 and $79,000 | 64 or younger | ✅ if age and AGI criteria are met | ✅ | ✅ in all states | ✅ in AL, MT, RI, and WV |

| ezTaxReturn | $79,000 or less | Any | ✅ if residency and AGI criterion are met | ✅ | ✅ in AL, AR, AZ, CA, CO, CT, GA, ID, IL, KS, KY, LA, MA, MD, MI, MN, MO, MS, NC, NH, NJ, NM, NY, OH, OK, PA, SC, VA, WA, and WI | ❌ |

| 1040NOW | $68,000 or less | Any | ✅ | ✅ | ✅ in AL, AR, AZ, CA, CO, CT, DC, DE, GA, HI, IA, ID, IL, KS, KY, LA, MA, MD, ME, MI, MN, MO, MT, MS, NC, ND, NE, NM, NJ, NY, OH, OK, OR, PA, RI, SC, SD, UT, VA, VT, WI, and WV | ❌ |

| 1040.com | Between $17,000 and $79,000 | Any | ✅ if AGI criterion is met | ✅ | ✅ in all states | ✅ in AL, AR, AZ, GA, IA, ID, IN, KY, MA, MI, MN, MO, MS, MT, NC, ND, NY, OR, RI, SC, VA, VT, WI, and WV |

| IRS Direct File | $200,000 or less if W-2, 1099-G, or SSA-1099. | Any | ✅ | ✅ | ✅ in AZ, CA, FL, MA, NV, NH, NY, SD, TN, TX, WA, and WY | ✅ in AZ, CA, MA and NY |

Additional Free Tax Partners

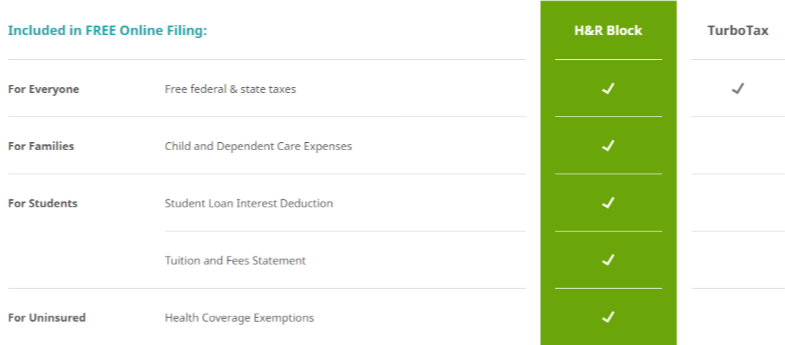

H&R Block Free – Another free federal and state tax option is H&R Block. On top of being free, they're heavily promoting the difference between them and TurboTax.

H&R Block is offering 45 forms required for filing your free online taxes, which is twice as many as TurboTax. They specifically mention these situations to look out for.

- For Families – Child and Dependent Care Expenses

- For Students – Student Loan Interest Deduction

- For Students – Tuition and Fees Statement

- For Uninsured – Health Coverage Exemptions

Obviously, if any of these situations apply to you, H&R Block sounds like the way to go! Here's a full list of supported forms on their “free online” plan.

Credit Karma Tax – Credit Karma Tax is a premium product that's 100% free, from start to finish. That includes all of our super-useful features, plus free filing for all supported forms and situations. Have a side-hustle? Own a home or sold some stock? Other tax services might charge you to itemize these deductions – but we don't.

From what I can tell, they don't even have a premium plan, so there's really no coupons or promo codes needed.

I will note that I've seen some negative reporting on this company. Long story short, they use your tax returns to target you with financial advertising…

TurboTax Free Edition – As of 2022, I can no longer recommend TurboTax Free as a good filing option. Pro Publica recently published a scathing expose detailing all the complex ways Turbo Tax tries upselling you to pointless services you don't need.

TurboTax still offers both free federal and state tax returns if you qualify and only need basic forms, like a 1040. But overall, I'd personally prefer to go with a different company.

Free Military Tax Options

Those in the military have an extra option with MilTax. It's a free service by the Department of Defense that uses a version of H&R Block's software. It's available to all active-duty service members, anybody in the National Guard or the reserves, and to their families. Their free program has no income or tax form restrictions as well!

One nice perk is they have both a free toll number (800-342-9647) and a live chat if you have any tax questions!

Where can you get free personal tax help?

If you need help with filing your taxes, you may qualify for the free IRS' Volunteer Income Tax Assistance (VITA) program if any of these conditions apply to you:

- People who generally make $64,000 or less

- Persons with disabilities

- Limited English-speaking taxpayers

The IRS has operated this free service for over 50 years!

There is also a free IRS' Tax Counseling for the Elderly (TCE) program that can help you if you are at least 60 years old. This service specializes in n questions about pensions and retirement-related issues unique to seniors.

Both VITA and TCE sites are managed by IRS partners and staffed by their volunteers who want to make a difference in their communities. The IRS-certified volunteers who provide tax counseling are often retired individuals associated with non-profit organizations that receive grants from the IRS.

VITA and TCE sites are generally located at community and neighborhood centers, libraries, schools, shopping malls and other convenient locations across the country.

To locate the nearest VITA site near you, use the VITA Locator Tool or call 800-906-9887.

To locate the nearest TCE site near you, use the AARP Site Locator Tool or call 888-227-7669. These sites are typically only open between January and April.

Wrapping Up

So there you have it! With one of those sites, you should be able to file both of your taxes for free or extremely cheap.

Now hopefully we get a break from all these taxes next year! I hear it's a leap year, that's gotta help us somehow.